About David Hancock

David is the Founder and Managing Director of Binnari Property, a team of independent, ethical and reliable property investment professionals, who specialise in researching and providing advice on residential real estate investment properties for clients.

www.binnari.com.au

Whether it be your home or an investment, buying a property is one of the most significant investments you’ll make in your lifetime. And, you should know what you’re looking for in an investment property. It’s no surprise that people want to get it right when they decide to take the leap. Constant commentary from media outlets and property ‘experts’ generally puts people in two minds around the best time to invest.

To start with, it is always the right time to buy your home. Buying a property to live in is a different practice especially if you are seeking specific aspects that aren’t often available. For example a property within a school zone or nearby transport etc.

So, when is the right time to invest?

Well, hindsight is a wonderful thing, so investing in Sydney 10 years ago would have been a great decision but that’s not what you were being told at the time. At the time, you would have heard the same negativity that you’re hearing now.

The good news is, the next best time to invest in property is right now.

The beauty of the Australian property market is its segmentation. At any given time, our capital city markets are at different points in their respective property cycles. This means for investors that opportunities are always present. Sometimes it just takes the right guidance or an investment outside of an area you’re familiar with.

Our property performance is underpinned by the nation’s growing population. Some cities benefit from higher levels of growth than others. Currently, around 78% of our population reside in Sydney, Melbourne and Brisbane. The ABS reports that 88% of new population growth is headed towards the same three cities.

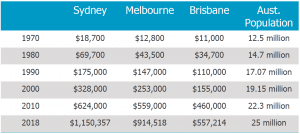

The figure below, tracks the median house price of each of the 3 cities at 10-year intervals. It also shows the movement in the Australian population.

What this figure really illustrates is that despite the many moving parts and external factors on the short-term performance of our market while our population continues to grow as does our demand for property.

The only time the stability or performance of a market comes into question is when parts of a cycle are viewed in isolation. For example, looking at the Sydney market over the past 18 months where the median house price has fallen 10 – 15% depending on the location. This would suggest a market in a terrible state.

When you consider that in the 6-years prior the market grew by over 80%, the 10 – 15% doesn’t sound too bad. Property investment is a long-term strategy, it’s not a get rich quick scheme. The timeframe in which you hold a property is just as important as purchasing the right property.

Conclusion

Ten years from now, the fear of election and lending uncertainty will be a thing of the past, the markets resilience has been tested many times before and consistently it delivers. Don’t let fear drive your decision making.