Will Sydney Property prices fall?—a question many of us are asking.

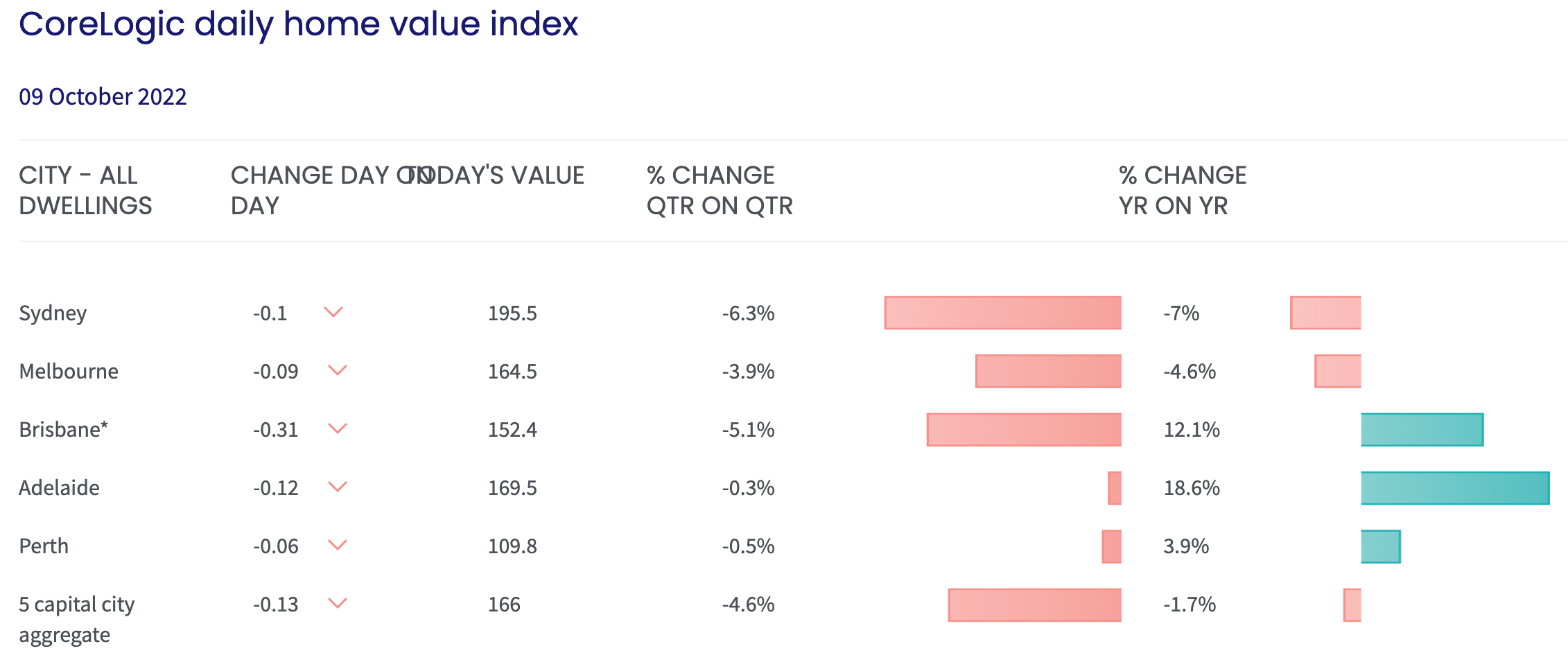

The Sydney house price growth in the last 20 years has continued to rise on a general level. However, over the past year, Sydney house prices have dropped by 6.3% and this decline is continuing. This is particularly interesting as 2021 recorded some of the highest property prices ever.

Tim Lawless, the Research Director at property data firm, Corelogic, has stated that this is the sharpest decline in values in almost 40 years.

So what’s causing Sydney real estate prices to fall and what can we expect from the housing market in the coming months?

Are Sydney house prices falling?

Data from Corelogic show that property prices in Sydney are indeed falling. The Sydney property bubble that had been growing from the onset of low interest rates might have burst.

But first, let’s give a little background—the housing values in Sydney “have grown more than 400% in the past 30 years.” Population growth in the city has been strong. While it currently has around 5.3 million residents, it’s expected to grow to 8 million around 2050. With an increased population within the same amount of space, prices will only go up.

CoreLogic’s daily home value index indicates that housing prices in NSW’s capital city:

- are down -1.8% over the past month

- dropped -6% over the past 12 months

But Sydney isn’t the only capital city that’s affected—Melbourne house prices, Canberra and Hobart also reported house price falls, as did Brisbane for the first time since 2020.

The decline in the Sydney property market started even before the first increase of interest rates in May 2022. At one point, the house prices were just too high, creating housing affordability issues.

First home buyers were driven to invest in units instead, which were more affordable. This explains why the decline in property prices for units, at around 0.6% since last quarter, didn’t drop as quickly as house prices, which dipped by 2.7%. Then, with the found round of rising interest rates that started in May, there was a reduction in borrowing power, pulling the average figures down even further.

Why are Sydney property prices falling?

There are a few reasons why Sydney house prices started to fall in the second half of 2022:

Affordability constraints

Sydney house prices have grown tremendously over the past decades. Between September 2020 and January 2022, for instance, prices rose by 27.7%. This was brought on by the lowering of interest rates which encouraged first home buyers to take the leap.

When property prices were driven up, there were eventually issues with affordability. Even with a record low interest rate of 0.1%, the down payment on a home was hard to reach, and entering the property market meant you’d be in a high level of debt.

Higher interest rates bite

In May 2022, the RBA (Reserve Bank of Australia) began the cash rate hikes and the lenders followed suit. No longer were the interest rates at a feasible 0.1%.

As of October 2022, the cash rate has been increased six times, and it isn’t stopping anytime soon.

With the current interest rate at 2.60%, this increases loan repayments by potentially hundreds of dollars per month. Mortgage costs dissuade first home buyers, therefore impacting the Australian property market.

Inflation

The rising inflation in June 2022 hit a 32-year high and experts say it’s going to peak at about 7%.

When prices of everyday items like food and gas get higher, our budgets tighten. When wages growth isn’t increased with the inflation rate, they tighten even further. Home buyers who were perhaps once motivated, with their finances almost in place, now have to spend more of their monthly salaries on their day-to-day living, instead of on their dream home.

This higher cost of living brings down consumer confidence and eventually the property values.

Is 2022 a good year to buy a house in Sydney?

Bank forecasts are saying that rising interest rates will stabilise (or even reduce) around the end of 2023. Until then, Tim Lawless is saying we can expect house values to drop by 15% in the capital cities like Sydney and Melbourne.

Looking at it simply, slowing down the house price growth can be a good thing as it means home price are more affordable, which tackles the aforementioned affordability issues.

With less demand, the housing supply goes up, putting buyers in the power seat. Having said that, mortgage costs are still a big concern. Buyers are basically paying more to be in debt.

Some experts advise buying now and not waiting, assuming you have your financial situation in check. The Sydney housing market is solid, with a unique lifestyle few other cities can offer. It is fuelled by both interstate migration and expats from overseas attracted by the hybrid of cosmopolitan and natural landscape.

So, even if you end up buying a home and the housing values drop, chances are, it will only be temporary. The Sydney property market will evolve again and Australian property prices will bounce back.