If you’re considering an interest-only home loan, we explain how they work, how the rates compare to other loans and what pros and cons you may want to think about before deciding.

Some people might see an interest-only home loan as an attractive choice when considering finance options for a property. The prospect of lower repayments for a period of time to free up cash for other purposes might be appealing, for example.

It’s worth bearing in mind, though, that as well as the potential plusses, this setup can have drawbacks, most notably the potentially greater long-term cost compared to other options. If you’re considering an interest-only home loan, it’s important to do your research so you understand what you’re committing to. Canstar explains:

- What is an interest-only home loan?

- How do principal and interest home loans differ from interest-only home loans?

- What are the benefits of an interest-only home loan?

- What are the disadvantages of an interest-only home loan?

- What happens at the end of the interest-only period for a home loan?

- How can I compare interest-only home loans?

What is an interest-only home loan?

An interest-only (IO) home loan is a lending arrangement where you only repay the interest on the amount you have borrowed for a set period of time. You don’t have to repay the principal (the loan amount) during that period, like you would with a principal and interest (P&I) loan.

During the interest-only period your repayments would be lower, but would go up once you start paying off the principal component of the loan.

The maximum interest-only loan period is typically five years for owner occupiers, but may be longer for investment loans. After this period, the loan reverts to principal and interest repayments.

It’s common for the interest-only period to come in one chunk at the start of the loan term, but some lenders may offer borrowers the ability to switch between interest-only and principal and interest repayments throughout the life of the loan, up to the maximum total interest-only period.

As we’ll see, interest-only loans may offer particular benefits to property investors and are generally more commonly available to these borrowers. For example, interest-only loans make up a higher proportion of the loans on Canstar’s database available to investors than they do for owner occupiers.

Construction loans and bridging loans are other types of property finance that are commonly based on interest-only repayments for a part of the term.

Are interest-only home loans more expensive than principal and interest loans?

Generally speaking, interest-only home loans work out to be more expensive than principal and interest loans in the long run. This is due to the higher interest rates charged on average on interest -only loans and the fact that you are being charged interest on the whole loan amount interest-only period. By contrast, with a principal and interest loan you would be paying down the balance gradually from the start.

To demonstrate the potential cost difference, Canstar Research analysed the relevant products available on our database.

Interest rates for owner occupiers

| Minimum variable rate | Average variable rate | Minimum 5 year fixed rate | Average 5 year fixed rate | |

| Principal and interest | 2.19% | 3.37% | 2.39% | 2.95% |

| Interest-only | 2.59% | 3.84% | 2.49% | 3.59% |

Source: www.canstar.com.au – 22/10/2020. Based on home loans on Canstar’s database available for a loan amount of $400,000 and 80% LVR, excluding introductory and first home buyer only loans.

Interest rates for investors

| Minimum variable rate | Average variable rate | Minimum 5 year fixed rate | Average 5 year fixed rate | |

| Principal and interest | 2.54% | 3.74% | 2.69% | 3.27% |

| Interest-only | 2.79% | 3.98% | 2.84% | 3.46% |

Source: www.canstar.com.au – 22/10/2020. Based on home loans on Canstar’s database available for a loan amount of $400,000 and 80% LVR, excluding introductory and first home buyer only loans.

Of course, interest is just one of the costs of borrowing to buy a property. It may be worth also factoring in the fees charged on the loan, either upfront or regular. The loan comparison rate is designed to help borrowers assess the true cost of a loan, including interest and most fees, based on an example loan amount and term.

Total interest paid – owner occupier

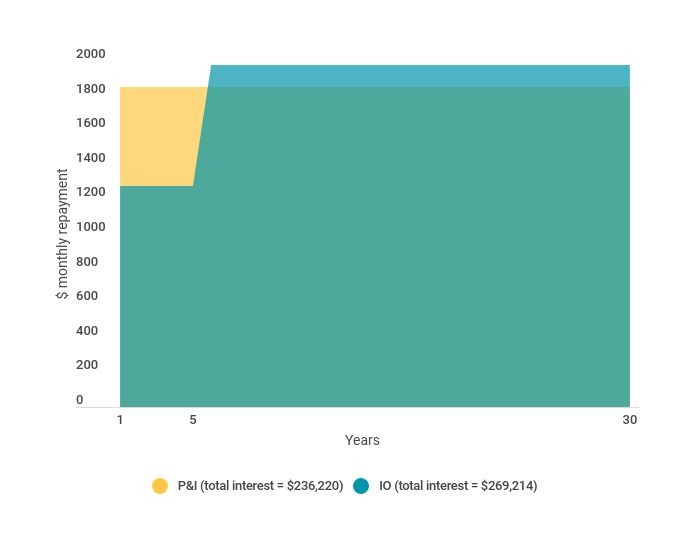

The table below shows the total amount of interest paid on a hypothetical $400,000 loan with a loan to value ratio (LVR) of 80% over 30 years, based on the average principal and interest and interest-only interest rates for owner occupiers on Canstar’s database. The interest-only example is based on a five-year interest-only period at the beginning of the loan term.

| Monthly repaymentyears 1-5 | Monthly repaymentyears 6-30 | Total interest | |

| Principal and interest | $1,767 | $236,220 | |

| Interest-only | $1,280 | $1,975 | $269,214 |

| Difference | -$487 | $208 | $32,994 |

Source: www.canstar.com.au – 22/10/2020. Based on variable home loans on Canstar’s database available for a loan amount of $400,000 and 80% LVR, excluding introductory and first home buyer only loans. Monthly repayment and interest calculations assume a total loan term of 30 years. Interest-only calculations assume the rate reverts to the average P&I rate after five years.

Here’s what this hypothetical comparison would look like over a 30-year loan for an owner occupier:

Total interest paid – investor

The table below shows the total amount of interest paid on a hypothetical $400,000 loan with a loan to value ratio (LVR) of 80% over 30 years, based on the average principal and interest and interest-only interest rates for investors on Canstar’s database. The interest-only example is based on a five-year interest-only period at the beginning of the loan term.

| Monthly repaymentyears 1-5 | Monthly repaymentyears 6-30 | Total interest | |

| Principal and interest | $1,850 | $266,070 | |

| Interest-only | $1,327 | $2,054 | $295,924 |

| Difference | -$523 | $204 | $29,854 |

Source: www.canstar.com.au – 22/10/2020. Based on variable investor home loans on Canstar’s database available for a loan amount of $400,000 and 80% LVR, excluding introductory and first home buyer only loans. Monthly repayment and interest calculations assume a total loan term of 30 years. Interest-only calculations assume the rate reverts to the average P&I rate after five years.

What are the benefits of an interest-only home loan?

Some of the the potential benefits of an interest-only home loan may include:

1. Lower regular payments for a period

Because you are paying only the interest component on your home loan, your regular repayment will be comparatively lower during that period, before reverting to a higher regular principal and interest repayment amount.

If you experience a reduction in income or go through a period of financial hardship for another reason, temporarily switching your loan repayments to interest-only could help make your loan repayments more manageable. Some lenders have been offering this option to customers affected by the coronavirus pandemic, for example. You would need to discuss this with your lender first, as not all providers will allow customers to do this. It may also be helpful to discuss your options with a financial counsellor.

2. Free up cash to use elsewhere

Having lower repayments during the interest-only period could be helpful if you need spare cash for other purposes. For example, a first home buyer might prefer to keep their loan repayments as low as possible after they buy their home, and while they rebuild their savings or an emergency fund, or purchase furniture for their new home. But as we’ll see, this strategy can present risks too.

3. Advantages for investors

An interest-only home loan may present potential tax benefits to investors, according to Moneysmart, by allowing them to claim higher tax deductions. It may be worth seeking tax advice from a qualified adviser before taking this approach.

In addition, the money not being spent on paying down the loan’s principal could be used to pursue other investment opportunities. This approach may be particularly beneficial if the investor manages to sell the property for a profit within the interest-only period, as they would have minimised their investment costs in that time by only making interest repayments.

Compare Investment Home Loans with Canstar

What are the disadvantages of an interest-only home loan?

Here are some of the potential cons of choosing an interest-only home loan:

1. Your repayments will eventually go up

When your interest-only period comes to an end, your repayments will increase as you begin to repay the principal of the loan as well. This may come as a shock, particularly if your circumstances have changed since you took out the loan. Based on the Canstar Research findings earlier in the article, a hypothetical borrower with a $400,000 loan and 80% LVR (excluding introductory and first home buyer loans) would need to budget for an extra $695 per month in loan repayments for the remaining 25 years ($1,975 monthly, instead of $1,280) if their interest-only period ended five years into their loan term. In contrast, if they had chosen a principal and interest loan to begin with, they would have paid $1,767 per month for the whole life of the loan, based on average interest rates for variable home loans at the time of writing on Canstar’s database.

2. More expensive in the long run

More on this to come, but generally speaking with an interest-only loan you end up paying more in interest over the life of your loan than you would with a principal and interest loan. Two factors are largely responsible for this:

- The interest rates available are generally higher.

- Even without a difference in interest rate, because you are not paying down the loan’s principal, you are charged interest on the full loan amount throughout the interest-only period.

By contrast, with a principal and interest loan, the principal amount would gradually decrease, and as a result so too would the amount of interest being charged, assuming your interest rate doesn’t go up.

3. Less equity in your property

During the interest-only period, because you’re not paying back any of the loan’s principal, you are not increasing your equity in the property. In other words, the amount of the property that you own stays the same.

This could present a risk to first home buyers in particular, as they may be starting with a low amount of equity in their property – less than 20% in some cases. In this situation, it may be difficult for the borrower to refinance their mortgage to another lender during the interest-only period.

Your equity could still go up if the property increases in value, but on the flip side of that, if your property’s value decreases, your equity could drop. This could be particularly problematic if you want to sell your home, as in some cases you could end up owing more on your loan than the property is worth. This is known as being in negative equity.

What happens at the end of the interest-only period for a home loan?

When you have reached the end of your loan’s interest-only period, you have a few options. Firstly, you can simply revert to the higher principal and interest repayments as planned. Alternatively, you may be able to negotiate an extension or another solution with your lender if your circumstances mean the increased repayments are going to be challenging. If you are experiencing hardship, a financial counsellor may be able to provide advice on your options.

In the lead up to transitioning to higher principal and interest repayments, Moneysmart suggests you could gradually increase your loan repayments so that there is less of a shock when you eventually have to cover the full regular amount.

If you are in a position to do so, you could always shop around for a lower interest rate to help make the transition back to principal and interest repayments more manageable. The interest rates on offer from different lenders may also have changed during your interest-only period, so it could be beneficial to take another look at what’s on offer, either way.

How can I compare interest-only home loans?

Overall, if you’re considering an interest-only home loan, it may be a good idea to be mindful of the potential pros and cons, research what’s on offer from a selection of providers, read the loan terms and conditions (and the product’s key facts sheet) carefully before committing and perhaps even get some professional advice if necessary.

When comparing loans, consider weighing up your options based on the interest rate and the fees charged, as well as the loan features that lenders offer.

Canstar’s Home Loan Star Ratings may help you to determine which loans offer value for money based on a broad range of factors.

Interest-only home loan FAQs

Are interest-only home loans a good idea?

This will depend on your circumstances. In some cases, an interest-only home loan could help by freeing up cash flow for borrowers, such as investors, but they would need to be mindful of the increased costs and potential risks.

Who is eligible for an interest-only home loan?

Individual lenders will assess who is eligible for their interest-only home loans, but generally would apply similar criteria to their other loans. Because of the potential for greater risk with this kind of loan, lenders may apply stricter checks on borrowers.

Can I pay interest-only on a fixed mortgage?

Yes, some interest-only home loans come with a fixed rate of interest. With this kind of loan, your interest rate would stay the same during the fixed rate period. If the fixed rate period ends while you are paying interest only, your interest rate and repayments could change.

Can I sell my home if I have an interest-only home loan?

It’s generally possible to sell your home during your home loan’s interest-only period, although it may be challenging if your equity in the home is low. If selling your home involves you using the sale funds to pay out the home loan, you may incur break costs, particularly on fixed rate loans.

Can I make extra repayments on an interest-only home loan?

Depending on the loan terms and conditions, it may be possible to make extra repayments on your interest-only home loan. This option is generally more common on variable rate home loans than fixed loans.

Can my interest rate change with an interest-only home loan?

If you have a variable rate home loan, your rate may change, even during the interest-only period. If your interest rate went up, your regular repayments would go up too and vice versa.

This article was written by Sean Callery, Deputy Editor of Canstar, and was originally published on Canstar as What are interest-only home loans and are they worth it?